With the number of economic and public health uncertainties worldwide, it’s important to diversify away from systematic risks that materialize when you invest in a limited number of asset classes. Alternative investments are financial options that don’t fall into the conventional silos of stock, cash, or fixed income markets — they often provide market uncorrelated income and yield in times of uncertainty. This article is the first in a series from Echelon on non-traditional alternative investments for Canadian High Net Worth investors. Here, we cover investments in private equity, private debt, and real assets.

Private Equity

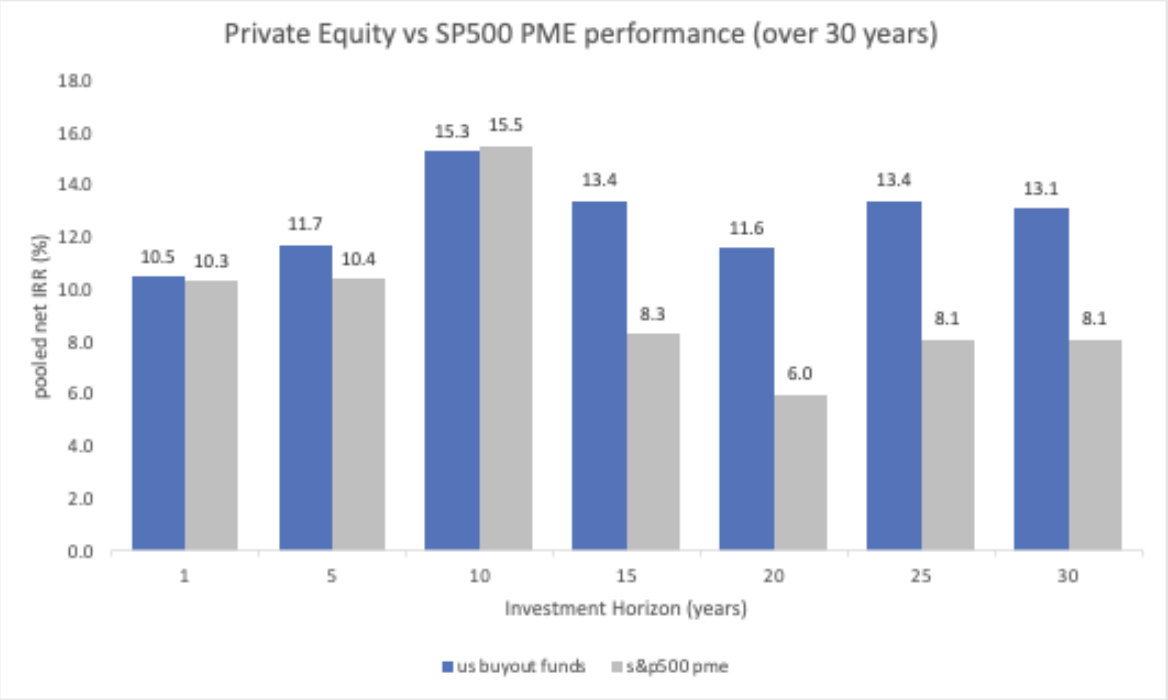

Private equity has a long history in Canada as a successful vehicle which delivers stable, above market returns, and some of the largest companies in Canada, such as Tim Hortons and Westjet, are supported by private equity financing.

As opposed to public market investment, an investment in a private equity fund allows you to directly take ownership in companies unavailable to the average investor. The companies which private equity funds invest in are often high-growth firms not yet large enough to list in public exchanges, or stable cash flow positive firms that do not want to lose their long term focus as a result of public sentiment, reporting, and pressure.

Private equity investments are usually conducted in rounds where an investor contributes to a fund, which then uses the cash (called “dry powder”) to buy out or make large investments in firms over a specified time period, usually around five to seven years. As a result of these holdout periods, private equity is an illiquid investment. Exiting often requires finding an over the counter buyer through a secondaries market.

Private Debt

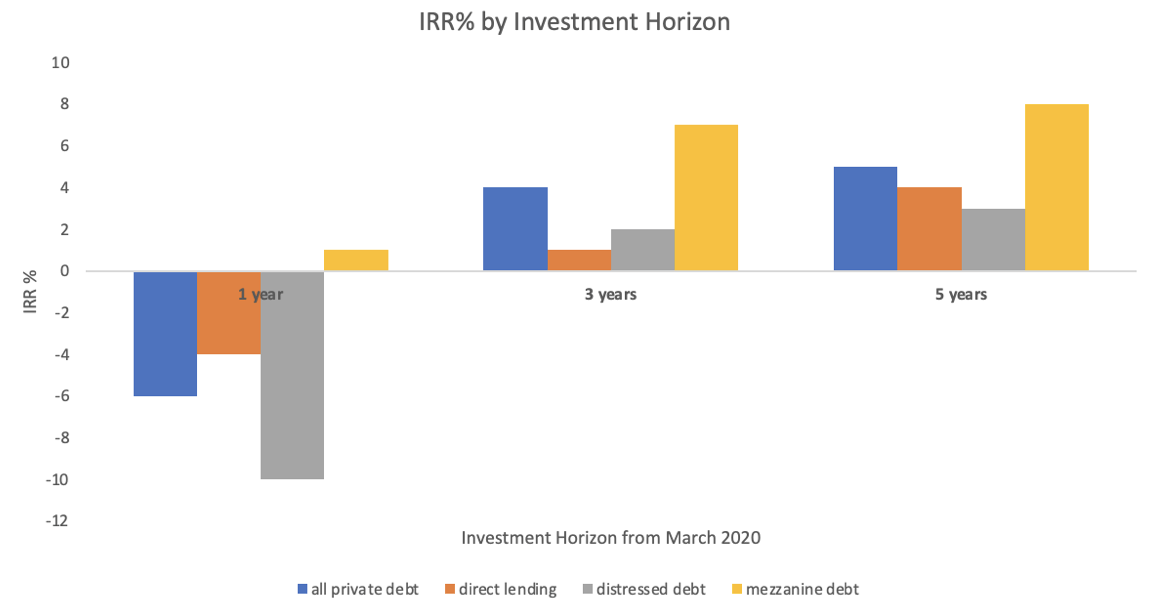

Another large alternative investment market, analogous to private equity, is private debt. Private debt yields higher returns than comparable public debt and is relatively uncorrelated to the market.

Canadian private debt is a large market which offers sophisticated investors the opportunity to participate in financing firms directly. This type of financing could be used by firms for a variety of purposes such as mezzanine financing (traditionally used as a bridge loan for acquisitions and in real estate), working capital financing, or growth (PP&E) financing.

Borrowers are often middle-market — unable to secure financing from large commercial banks due to a lack of compatibility or size. Private debt funds provide funding in return for a yield premium that is balanced by the illiquidity that is present by investing in the firm: it’s tough to sell loans in a private market for a relatively smaller issuer. Upstream, investors in private debt funds receive exposure to multiple such loans, and although the default rates for these mid-market firms are low, the fund provides additional security through collateralization.

Real Assets

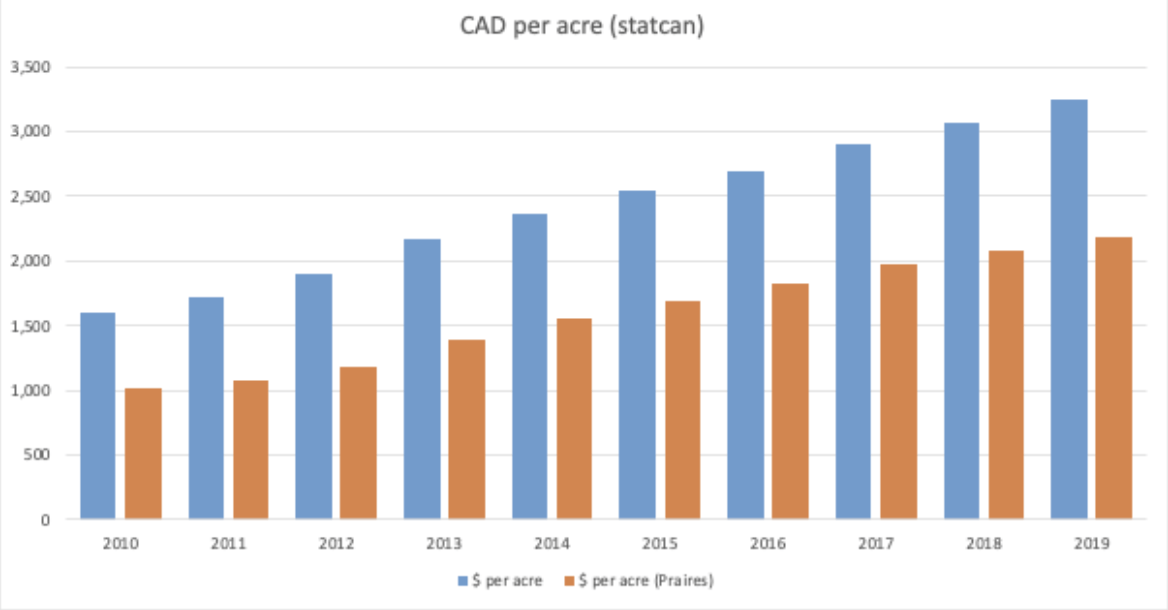

Residential investments are often the first investment opportunities that come to mind when considering Canadian real assets. There are a number of others areas that warrant consideration. As a resource rich country, Canada supports large energy and natural resource focused industries: one such market is agriculture.

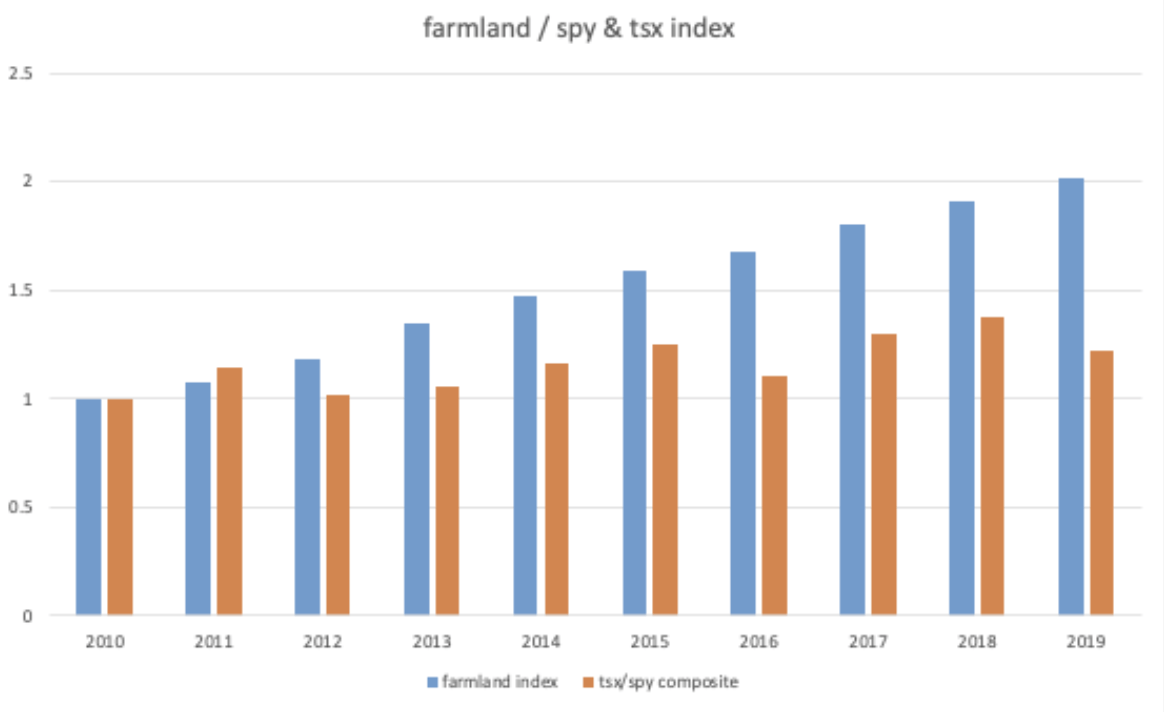

Agricultural land is available throughout Canada, in areas like Northern Ontario, Alberta, and Saskatchewan. This land is always in demand, and supply is limited. Yields are similar to residential properties and vary marginally based on province. However, agricultural land has comparably stronger fundamentals: farmland generates income for its renters, is subsidized by the government, and is considered a strategic national interest. Land owner rights are also stronger, and tenants often sign multi-year contracts since there is usually stable demand for crops. This has supported strong average annual rates of return. Canadian farmland investments over the last 10 years have exceeded the return on the TSX/SPY by more than 2%.

There are a number of funds offering agricultural investments in Canada including Bonnefield — a private equity vehicle with over $1 B in AUM and 134,000 acres of Canadian farmland, and Area One Farms, which has over $450 M in AUM with over 140,000 acres of Canadian farmland.

Alternative Investments

Private equity, private debt, and real assets are all excellent opportunities to consider investing in. They generate consistent yield and improve your portfolio diversification at the cost of some liquidity.

Connect with your Echelon Investment Advisor to Discuss your needs, this information or any other questions you may have.

Sources:

- Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

- Unless publications are specifically marked as research publications of Echelon Wealth Partners Inc. (“Echelon”), the views expressed therein (including recommendations) are those of the author and, if applicable, any named issuer or investment dealer alone and they have not been approved by nor are they necessarily those of Echelon. Echelon expressly disclaims any and all liability for the content of the any publication that is not expressly marked as a research publication of Echelon.

Charts are sourced to Bloomberg L.P. unless otherwise noted.

The contents of this publication were researched, written and produced by Richardson Wealth Limited and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. The information contained has not been approved by and are not those of Echelon Wealth Partners Inc. (“Echelon”), its subsidiaries, affiliates, or divisions including but not limited to Chevron Wealth Preservation Inc. This is not an official publication or research report of Echelon, the author is not an Echelon research analyst and this is not to be used as a solicitation in a jurisdiction where this Echelon representative is not registered.

The opinions expressed in this report are the opinions of its author, Richardson Wealth Limited (“Richardson”), used under a non-exclusive license and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. (“Echelon”) or its affiliates.

This is not an official publication or research report of Echelon, the author is not an Echelon research analyst and this is not to be used as a solicitation in a jurisdiction where this Echelon representative is not registered. The information contained has not been approved by and are not those of Echelon, its subsidiaries, affiliates, or divisions including but not limited to Chevron Wealth Preservation Inc. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete.

Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Echelon and Richardson do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.